Schedule a meeting with us and get a sneak peak of SureCost Drug Shortages Insights™ to quickly identify and respond to risks.

Download the white paper

Complete this form to get the PDF version of our white paper.

Drug prices in the United States are some of the highest in the world. High demand amidst global volatility and market compression in a post-pandemic landscape has led to price fluctuations. However, the Inflation Reduction Act (IRA) will worsen the situation.

Pharmacies are no strangers to high drug prices and shortages. Yet these challenges are about to get even harder. This white paper will explain why price fluctuations and drug shortages will become even more costly and complex. Then, we’ll outline a strategy to mitigate the impact of these rising drug prices and shortages. We’ll also highlight how solutions like SureCost empower pharmacies to turn disruption into opportunity through smarter, tech-enabled purchasing. By incorporating predictive modeling, drug shortage solutions anticipate shortages before they occur— securing inventory, protecting rebates and maintaining patient care—rather than scrambling to react once supply is already constrained. It takes the right approach and solutions for navigating drug shortages, but pharmacies can succeed amidst these issues.

Forces Disrupting Pharmacy Purchasing

Pharmacy purchasing is unpredictable, unstable and under pressure. Market forces are driving increases in drug prices and drug shortages at an unprecedented rate. The pharmacy supply chain isn’t just disrupted; it’s volatile.

Market Pressure from the Inflation Reduction Act

The IRA aims to lower prescription drug prices, including specific Medicare-covered drugs. How? By capping patients’ out-of-pocket costs and limiting the prices manufacturers can charge for these drugs. If a drug company raises prices faster than the inflation rate, it has to pay a rebate to Medicare.

While the IRA aims to lower prescription drug costs for consumers, pharmacies will see even higher drug costs. That’s because the “inflation penalty” for manufacturers will change how they set and raise prices.

Rising drug costs demand smarter, tech-enabled pharmacy purchasing.

Pharmacies need backup sourcing if a wholesaler’s fill rate dips from 96% to 70% overnight, as we saw with GLP-1s earlier this year.

Manufacturers will compensate by launching new drugs with higher prices. They’ll also adjust their production portfolio to stay competitive in this new landscape. Commercial insurance plans will also change to gain similar advantages. Likewise, pharmacy benefit managers (PBMs) will update formularies to compensate for lower margins. Pharmacies should expect to see new, higher-priced drugs enter the market.

Close-up on IRA Phase 1

Phase 1 of the IRA starts with 11 drugs (16 products) that will have a “maximum fair price (MFP)” subject to price negotiation in 2026:

IRA-Applicable Drugs in Phase 1

- Eliquis

- Enbrel

- Jardiance

- Imbruvica

- Xarelto

- Stelara

- Januvia

- Fiasp, Fiasp FlexTouch and Fiasp PenFill

- Farxiga

- NovoLog, NovoLog FlexPen and NovoLog PenFill

- Entresto

The list includes some of the most commonly used high-cost medications. The mix of therapeutic areas indicates the broad reach of these initial changes.

The first step for health system pharmacies to anticipate potential cost changes is understanding which drugs are affected. With another 15 drugs already planned for 2027, ongoing monitoring and adjustments to purchasing strategies are critical.

The Growing Impact of Pharmacy Drug Shortages

Drug shortages are also becoming more frequent and harder to predict. By the first quarter of 2024, the American Society of Health-System Pharmacists reported the highest number of shortages in nearly a decade. While that number has since decreased, there’s still a high rate of active drug shortages.

What causes record-breaking drug shortages? Obvious triggers include raw material shortages, supply chain issues with specific products or materials used to manufacture them and insufficient production to meet increased demand. Another factor is regulatory challenges (delayed inspections for overseas items, plant closures, etc.).

Artificial drivers also create real impacts. Companies stockpiling inventory create the impression of an actual shortage and affect supply and pricing. Manufacturers shifting their production portfolio means fewer manufacturers producing a larger percentage of products. That market compression pressures manufacturers to ramp up their volume, leading to issues with supply meeting demand (while allowing manufacturers even more control over what they can charge vendors).

Drug shortages now last 18 weeks on average (double the pre-COVID levels). A shortage of even one key item can disrupt patient care. The problem is so widespread that many healthcare systems convene standing committees to keep ahead of drug shortages.

Drug shortages are rising. Strategic sourcing is now essential.

With growing pressure to stay compliant while managing costs, every purchasing choice can have real consequences. Still, too many pharmacies stick to outdated purchasing models.

Staffing and Regulatory Strain Intensify the Burden

Alongside drug price increases and drug shortages, staffing shortages and increased burnout slow down operations. Overworked, stressed-out staff are more likely to make costly, dangerous mistakes when filling prescriptions or making purchases. They’re also more likely to leave their position, leading to costly turnovers and greater pressure on the rest of the team.

Greater regulatory complexity, such as DSCSA, accelerates the cost and complexity of pharmacy purchasing. Pharmacies are required to keep up with these regulations and the electronic- technical standards. Otherwise, they risk costly penalties and even legal sanctions.

Unfortunately, these are all long-term challenges that will grow more complex. Pharmacies must adapt quickly and efficiently. Otherwise, they risk impacts on patient care and solvency.

The Problem With Traditional Pharmacy Purchasing Practices

The most common example of these outdated, detrimental purchasing practices is manually searching and comparing catalogs to find the best purchasing option. The pharmacy purchasing ecosystem is a web of vendors, prices, product codes and more data spread across multiple catalogs and purchasing interfaces. And that data changes constantly.

Without the right strategy and solutions to mitigate the impact of drug shortages, pharmacy teams cannot consistently find the best purchasing option, especially when the lowest price is just one factor to consider. Primary vendor compliance, potential reimbursement, actual COGS and availability are variables impacting every purchase. This is hard enough when staff are not scrambling to find the correct item during an unexpected drug shortage.

Over-reliance on a single vendor puts pharmacies at risk when supply issues arise or allocations shift. When that vendor encounters supply issues or adjusts allocations due to low supply, these pharmacies can’t get what their patients need. Plus, the more one wholesaler controls a pharmacy’s spending, the less negotiating power they have. Premier’s 2024 drug pricing index showed that hospitals sourcing 80% or more from one vendor paid 2.7% more on generics and 1.4% more on brand-name drugs than their multi-sourced peers.

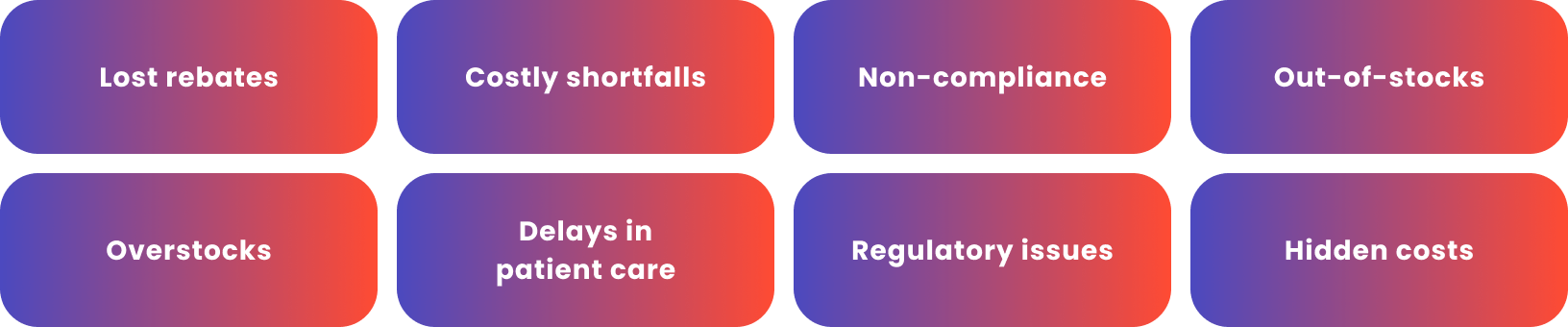

Some pharmacy professionals may note that these approaches are “how we’ve always done it.” But they’re costly, inefficient, time-consuming and stressful. Manual processes, vendor over-reliance and other traditional purchasing methods can lead to:

Outdated purchasing puts compliance, cost and care at risk.

Instead of siloed data and scattered purchase orders, pharmacies gain visibility into pricing. Leveraging a drug shortage solution like SureCost centralizes and analyzes data to calculate the best option in real time.

Strategies for Smarter Pharmacy Purchasing

To thrive despite drug price increases, drug shortages and other long-term issues, pharmacies have to rethink purchasing. The best purchasing strategy is flexible enough to adapt to market disruptions and shifts in clinical demands. Successful pharmacies also harness solutions that streamline work and use automation to enhance how teams work (without micromanagement). Let’s examine the four pillars of smarter purchasing.

Vendor Diversification

By diversifying their sourcing through an expanded vendor portfolio, health system pharmacies unlock a wider range of products, competitive pricing, bulk discounts and more opportunities to negotiate terms.

This is too much for pharmacy teams to accomplish without the right tools. Diversification without data is chaos, but diversification with automation provides a competitive advantage.

Pharmacies should look for a solution that:

- Aggregates all vendor catalogs

- Primary wholesaler

- Secondary and tertiary

- GPO/buying groups

- 340B account items

- Manufacturer-direct

- Standardizes purchasing data (i.e., apples-to-apples comparison)

- Ensures compliance before submitting a purchase order

- Models potential reimbursement before submitting POs

- Consolidates purchasing (i.e., submit all POs through one interface)

That means looking beyond the lowest price per unit. Successful buyers layer in rebates, prompt-pay, volume incentives and shipping fees. If a solution includes features like a purchase order optimizer, it automatically weighs those factors and reveals hidden savings. At SureCost, we’ve seen many pharmacies reduce their COGS by 4–6% in the first quarter alone.

The most advanced solutions go a step further with predictive modeling—helping you plan for drug shortages before they happen instead of scrambling to respond. By forecasting demand, monitoring market signals and factoring in vendor availability, you can secure the right inventory at the right time, protecting both margins and patient care.

Effective drug shortage solutions help pharmacies expand their options while optimizing compliance with their primary vendor. The technology lets teams install “guardrails” driving them to the right products to ensure compliance and meet rebate tiers, generic compliance thresholds and other agreement terms. If there are better purchasing options for non- compliant items, it routes those items to alternate vendors and models the advantage before they make a purchase. Based on SureCost data, one SureCost user preserved a $220K annual rebate while shifting 12% of volume to a secondary wholesaler during a heparin drug shortage.

Smarter vendor diversification saved one pharmacy $220K annually.

SureCost also supports both 340B and non-340B purchase orders by partnering with existing split-billing software. It routes orders intelligently through the wholesaler or warehouse to maintain 340B compliance while optimizing WAC and GPO purchasing.

Resilient Workflows and Inventory Management

As discussed above, staffing shortages are real and on the rise. Smaller teams are managing more patients and greater workloads. They’re also left with siloed data and complex processes.

An integrated purchasing solution streamlines pharmacy purchasing and inventory management to build a staffing- resilient workflow. It uses automation to standardize workflows, centralize PO management and task assignments and eliminate back and forth between departments. It also scales with pharmacy teams, even when teams get smaller.

For example, by automating checkpoints, a team member can quickly and confidently move an order from a worksheet to a purchase order. For recurring orders, they may program the system to automatically submit orders at certain times or days designated by that user.

Outdated Workflow Audit

- What to watch out for

- Visibility gaps: Staff can’t see what’s already been ordered, leading to duplicate orders and excess inventory.

- Missed tasks: Returns go unprocessed and POs are left in the cart without submission.

- Fragmented purchasing: Corporate teams can’t consistently enforce standard practices, leading to non-compliance and missed savings.

Data-Driven Inventory Management

Inventory should work hand in hand with purchasing. Otherwise, pharmacies miss low stock, depleted items or expired products and fail to replenish on time. They may place unnecessary orders and end up with excess stock that goes unsold or spoils on shelves. Overstock is a business liability, while understock delays care. Ineffective pharmacy inventory management prevents staff from working at “the top of their license” and saddles them with an often tedious task.

An integrated purchasing and inventory management solution enables data-driven inventory forecasting. Pharmacies can plan ahead without relying on “gut decisions” and guesswork. Decisions become proactive instead of reactive. Instead of pharmacy teams scrambling to order after discovering they’ve run out, staff can plan ahead using accurate, real-time data. Combining historical data and real-time views of inventory, including its actual purchased value, allows pharmacies to right-size their inventory and adjust stock levels “on the fly.”

Automation in pharmacy inventory management should include options for multiple flexible replenishment models: days-of, on-demand, just-in-time, etc. This ensures timely, efficient replenishment. It also frees staff from the burden of predictable product patterns while giving them enhanced business intelligence to guide other decisions. For example, cycle counts allow pharmacies to analyze high-cost, high-volume items that make the most impact.

Automated workflows and smart inventory free up pharmacy teams.

Most teams discover non-compliant orders after the fact, weeks later, when the invoice is due or a rebate is short-paid, when the damage is already done.

Confident Compliance

Vendor agreements are key to profitability. Ensuring compliance means avoiding penalties, but optimizing compliance, making the most of an agreement’s terms, leads to huge savings.

In other words, compliance isn’t just about avoiding penalties; it’s about making smarter decisions faster. But contracts are hard to manage manually. A primary vendor’s generic compliance ratio can be updated monthly. A sudden drug shortage or price spike can push just a few purchases off-contract and instantly diminish compliance from 95% to 89%.

Vendor agreements function like a second payer. They can drive up to 6% of drug spend back to a pharmacy’s bottom line. But pharmacies have to hit generic ratios, brand targets and source tiers (as spelled out in all the “fine print”). Missing by even a few points means eliminating the rebate.

An integrated purchasing solution tracks compliance continuously and provides real-time updates on progress, including how generic spend needs to be adjusted. These systems integrate contract terms and requirements. That information, when combined with the pharmacy’s purchasing data, allows the solution to:

Monitor generic compliance ratios and other contract terms

Identify non-compliant purchases before purchasing

Align orders based on agreements without overpaying

Recommend purchases to reach higher rebate tiers

Install virtual “guardrails” to steer teams to the right products

The system also flags non-compliant SKUs at the product-group level before submitting a purchase order (not weeks later). Automated recommendations for the lowest net-cost items keep pharmacies compliant, so they’re never forced to choose between price and rebates.

Smarter Pharmacy Purchasing in the Field

Guardian Pharmacy Services provides a useful case study for implementing these strategies.

As drug shortages worsened due to post-COVID-19 supply chain interruptions, Guardian needed access to a diverse vendor portfolio. They also wanted a solution for integrated data to make informed purchasing decisions and to automate their processes to save time and reduce errors. That’s when they implemented SureCost.

Key Impacts of SureCost at Guardian

- Access a wider range of vendors

- Easily compare and purchase from multiple sources

- Handle drug shortages more effectively

- Instantly view product availability and pricing across different vendors

- Ensure data-driven purchasing decisions and efficient management of reorders

- Use automation to generate POs, scan items at receiving and manage returns

- Streamline processes to save time and reduce manual errors

Real-time compliance prevents rebate loss and purchasing mistakes.

Schedule a demo or contact us to learn how SureCost can help your pharmacy thrive in today’s environment.

By leveraging SureCost’s drug shortage solutions, Guardian has achieved greater efficiency and improved purchasing strategies through reliable supply chain management. They always maintain a consistent supply of medications, mitigating the impact of drug shortages. They continue to see cost savings and improved resource allocation. Staff can now focus on patient care (not administrative tasks).

The Future of Pharmacy Purchasing

It’s unlikely that prescription drug products will get cheaper or become more abundant. Fortunately, as we’ve seen, health system pharmacies can take steps to meet these challenges. However, it takes the right planning and putting the right drug shortage solutions in place. SureCost gives pharmacy teams the visibility, flexibility and automation needed to make every purchasing decision count.

COMING SOON: Drug Shortage Insights™ powered by SureCost CoPilot™

Traditional pharmacy procurement software reacts to shortages. SureCost helps you plan for them.

- Smart reorder guidance: With AI capabilities powered by SureCost CoPilot™, pull fulfillment data and vendor alerts to suggest the safest, most cost-effective source.

- Shortage signals: Harnessing SureCost’s unique data, Shortage Signals leverages real-time inventories from wholesalers, distributors and key manufacturers to accurately predict supply shortages.

- Interactive trend timelines: Toggle quarters, months, weeks or days to see real-time shifts in supply.

- Watchlist analytics: Track grouped NDCs on a single dashboard and act fast when risk climbs.

- Predictive risk scores: Flags shortage probability so buyers act before shelves run low.